How sustainability benefits business performance

https://arab.news/4f6ak

Sustainability today is a core consideration in planning for organizational success. With tightening emissions targets and rising environmental awareness, there are tremendous pressures on businesses to become more sustainable.

This transition is not solely about compliance and social responsibility, however. It is about sustainability as a performance enabler — a driver of change that unlocks competitiveness and adaptability across the value chain.

Business sustainability can thus be described as a process of managing business activities in a way that maximizes efficiency without harming future generations.

Environmental sustainability, social responsibility, and corporate financial performance can all be included in the definition of the environmental, social, and governance concept, known in common parlance as ESG.

Sustainable value generation entails those actions that create and sustain growth, profitability, and enhanced value for shareholders in the long term.

There are clear economic benefits to be gained from greater sustainability. Embracing energy efficiency and reducing waste, for instance, cuts costs in production, while using renewables can minimize vulnerability to fluctuations in the price of fossil fuels.

Sustainable businesses are also able to attract cash from investors who prefer firms with strong ESG disclosures. Other analyses have revealed that a high ESG score reduces capital costs and enhances a firm’s performance.

The strategic management of environmental impact can bring both short and long-term benefits to organizations, including customer loyalty, reduced legal risks, and reputational capital.

Corporate social responsibility refers to the responsibilities that a business has to society and the impact of its operations on communities. To meet these responsibilities, firms are encouraged to respect labor practices and use ethical sources of labor.

Sustainability can give companies a competitive edge over their rivals, while at the same time being considerate to people and the planet.

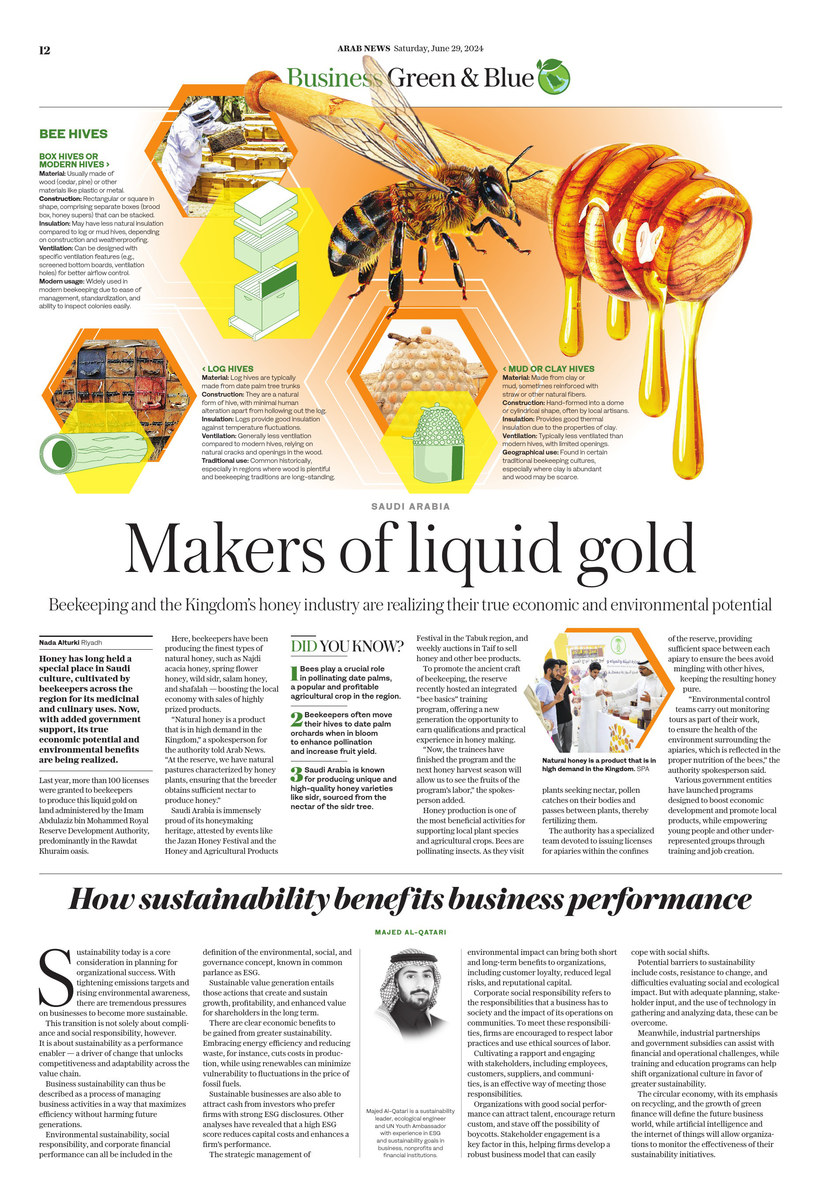

Majed Al-Qatari

Cultivating a rapport and engaging with stakeholders, including employees, customers, suppliers, and communities, is an effective way of meeting those responsibilities.

Organizations with good social performance can attract talent, encourage return custom, and stave off the possibility of boycotts. Stakeholder engagement is a key factor in this, helping firms develop a robust business model that can easily cope with social shifts.

Potential barriers to sustainability include costs, resistance to change, and difficulties evaluating social and ecological impact. But with adequate planning, stakeholder input, and the use of technology in gathering and analyzing data, these can be overcome.

Meanwhile, industrial partnerships and government subsidies can assist with financial and operational challenges, while training and education programs can help shift organizational culture in favor of greater sustainability.

The circular economy, with its emphasis on recycling, and the growth of green finance will define the future business world, while artificial intelligence and the internet of things will allow organizations to monitor the effectiveness of their sustainability initiatives.

In sum, sustainability can give companies a competitive edge over their rivals, while at the same time being considerate to people and the planet.

Every firm that dreams of a prosperous future should invest in sustainable practices, thereby guarantee lasting benefits for itself and its stakeholders.

• Majed Al-Qatari is a sustainability leader, ecological engineer and UN Youth Ambassador with experience in ESG and sustainability goals in business, nonprofits and financial institutions.